UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No.)

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| |

[X] ] | Preliminary Proxy Statement. |

| [ ] | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

[ ]X] | Definitive Proxy Statement. |

| [ ] | Definitive Additional Materials. |

| [ ] | Soliciting Material Pursuant to § 240.14a-12. |

ETF SERIES SOLUTIONS

|

| (Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

| (1) Title of each class of securities to which transaction applies: |

| (2) Aggregate number of securities to which transaction applies: |

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) Proposed maximum aggregate value of transaction: |

| (5) Total fee paid: |

o Fee paid previously with preliminary materials:

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

| (1) Amount Previously Paid: |

| (2) Form, Schedule or Registration Statement No.: |

| (3) Filing Party: |

| (4) Date Filed: |

VIDENT U.S. BOND STRATEGY ETF™ (VBND)

VIDENT U.S. EQUITY STRATEGY ETF™ (VUSE)

VIDENT INTERNATIONAL EQUITY STRATEGY ETF™ (VIDI)

U.S. DIVERSIFIED REAL ESTATE ETF (PPTY)

each a series of ETF Series Solutions

615 East Michigan Street, Milwaukee, Wisconsin 53202

[ ],May 15, 2023

Dear Shareholder:

I am writing to inform you about an upcoming special meeting (the “Special Meeting”) of the shareholders of the Vident U.S. Bond Strategy ETF™, Vident U.S. Equity Strategy ETF™, Vident International Equity Strategy ETF™, and U.S. Diversified Real Estate ETF (each, a “Fund,” and collectively, the “Funds”), each a series of ETF Series Solutions (the “Trust”). The Special Meeting is being held to seek shareholder approval of the Proposal (the “Proposal”) discussed below and in the accompanying Proxy Statement:

PROPOSAL: | PROPOSAL: | For shareholders of each Fund, separately, to approve a new investment advisory agreement between the Trust, on behalf of such Fund, and Vident Advisory, LLC (d/b/a Vident Asset Management) (“VA” or the “Adviser”) (the “New Advisory Agreement”). No increase in shareholder fees or expenses is being proposed. |

Enclosed you will find a notice of the Special Meeting, a Proxy Statement with additional information about the Proposal, and a proxy card with instructions for voting. Following this letter, you will find questions and answers regarding the Proxy Statement that are designed to help you understand the Proxy Statement and how to cast your votes. These questions and answers are being provided as a supplement to, not a substitute for, the Proxy Statement, which we urge you to review carefully.

The Board of Trustees of the Trust believes that the Proposal is in the best interest of the relevant Fund(s) and its shareholders and recommends that you vote “FOR” the relevant Proposal. Importantly, approval of the Proposal will not result in any increase in shareholder fees or expenses.

The Special Meeting is scheduled to be held at [TIME]11:00 a.m. Central time on [JUNE 9],June 9, 2023, at the offices of U.S. Bank Global Fund Services, 615 East Michigan Street, Milwaukee, Wisconsin 53202. If you are a shareholder of record as of the close of business on [MAYMay 9, 2023],2023, you are entitled to vote at the Special Meeting and at any adjournment thereof. Your vote is extremely important. While you are welcome to join us at the Special Meeting, most shareholders will cast their votes by filling out, signing, and returning the enclosed proxy card, voting by telephone, or voting using the internet.

We intend to hold the Special Meeting in person. However, we are sensitive to the public health and travel concerns our shareholders may have and recommendations that public health officials may issue in light of the evolving COVID-19 pandemic. As a result, we may impose additional procedures or limitations on Special Meeting attendees or may decide to hold the Special Meeting in a different location or solely by means of remote communication. We plan to announce any such updates on our proxy website www.proxyvote.com,www.videntam.com, and we encourage you to check this website prior to the Special Meeting if you plan to attend. We also encourage you to consider your options to vote by internet, telephone, or mail, as discussed in the enclosed proxy card, in advance of the Special Meeting in the event that, as of [JUNE 9],June 9, 2023, in-person attendance at the Special Meeting is either prohibited under a federal, state, or local order or contrary to the advice of public health care officials.

If you have any questions regarding the Proposal or Proxy Statement, please do not hesitate to call toll-free [866-839-1852].866-839-1852. Representatives will be available Monday through Friday, 9 a.m. to 10 p.m. Eastern time. Thank you for taking the time to consider these important Proposal and for your continuing investment in the Fund(s).

Sincerely,

/s/ Joshua Hinderliter

Joshua J. Hinderliter

Secretary

ETF Series Solutions

VIDENT U.S. BOND STRATEGY ETF™ (VBND)

VIDENT U.S. EQUITY STRATEGY ETF™ (VUSE)

VIDENT INTERNATIONAL EQUITY STRATEGY ETF™ (VIDI)

U.S. DIVERSIFIED REAL ESTATE ETF (PPTY)

each a series of ETF Series Solutions

615 East Michigan Street, Milwaukee, Wisconsin 53202

NOTICE OF SPECIAL MEETING

TO BE HELD ON [JUNE 9],JUNE 9, 2023

A special meeting of shareholders (the “Special Meeting”) of the Vident U.S. Bond Strategy ETF™, Vident U.S. Equity Strategy ETF™, Vident International Equity Strategy ETF™, and U.S. Diversified Real Estate ETF (each, a “Fund,” and collectively, the “Funds”), each a series of ETF Series Solutions (the “Trust”), will be held at [ ]11:00 a.m. Central time on [JUNE 9],June 9, 2023, at the offices of U.S. Bank Global Fund Services, 615 East Michigan Street, Milwaukee, Wisconsin 53202. At the Special Meeting, shareholders of the Funds will be asked to act upon the following Proposal:

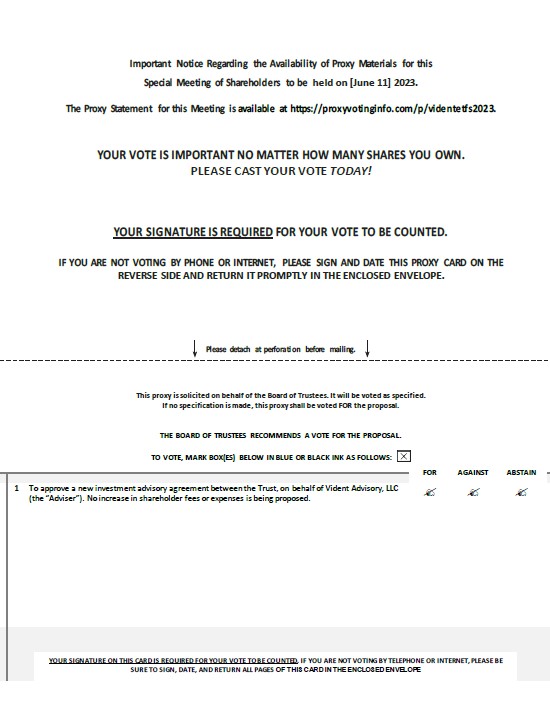

PROPOSAL: | PROPOSAL: | For shareholders of each Fund, separately, to approve a new investment advisory agreement between the Trust, on behalf of such Fund, and Vident Advisory, LLC (d/b/a Vident Asset Management) (“VA” or the “Adviser”) (the “New Advisory Agreement”). No increase in shareholder fees or expenses is being proposed. |

THE BOARD OF TRUSTEES, INCLUDING ALL OF THE INDEPENDENT TRUSTEES,

RECOMMENDS THAT YOU VOTE “FOR” THE PROPOSAL.

The Trust’s Board of Trustees has fixed the close of business on [MAYMay 9, 2023],2023, as the Record Date May 9, 2023, for the determination of the shareholders entitled to notice of, and to vote at, the Special Meeting and any adjournments thereof.

Please read the accompanying Proxy Statement. Your vote is very important to us regardless of the number of shares you hold. Shareholders who do not expect to attend the Special Meeting are requested to complete, sign, and promptly return the enclosed proxy card so that a quorum will be present and a maximum number of shares may be voted for the applicable Fund. In the alternative, please call the toll-free number on your proxy card to vote by telephone or go to the website shown on your proxy card to vote over the internet. Proxies may be revoked prior to the Special Meeting by giving written notice of such revocation to the Secretary of the Trust prior to the Special Meeting, delivering a subsequently dated proxy card by any of the methods described above, or by voting in person at the Special Meeting.

We intend to hold the Special Meeting in person. However, we are sensitive to the public health and travel concerns our shareholders may have and recommendations that public health officials may issue in light of the evolving COVID-19 pandemic. As a result, we may impose additional procedures or limitations on Special Meeting attendees or may decide to hold the Special Meeting in a different location or solely by means of remote communication. We plan to announce any such updates on our proxy website www.proxyvote.com,www.videntam.com, and we encourage you to check this website prior to the Special Meeting if you plan to attend. We also encourage you to consider your options to vote by internet, telephone, or mail, as discussed in the enclosed proxy card, in advance of the Special Meeting in the event that, as of [JUNE 9],June 9, 2023, in-person attendance at the Special Meeting is either prohibited under a federal, state, or local order or contrary to the advice of public health care officials.

By Order of the Board of Trustees

/s/ Joshua Hinderliter

Joshua J. Hinderliter

Secretary

ETF Series Solutions

LETTER DATE,May 15, 2023

IMPORTANT INFORMATION TO HELP YOU UNDERSTAND THE PROPOSAL

Below is a brief overview of the matter being submitted to a shareholder vote at the special meeting of shareholders (the “Special Meeting”) to be held on [JUNE 9],June 9, 2023. Your vote is important, no matter how large or small your holdings may be. Please read the full text of the proxy statement (“Proxy Statement”), which contains additional information about the proposal (the “Proposal”) and keep it for future reference.

QUESTIONS AND ANSWERS

Q. Why are you sending me this information?

A. You are receiving these proxy materials because on [MAYMay 9, 2023]2023 (the Record Date, “MAY 9, 2023”“Record Date”) you owned shares of Vident U.S. Bond Strategy ETF™ (“VBND”), Vident U.S. Equity Strategy ETF™ (“VUSE”), Vident International Equity Strategy ETF™ (“VIDI”), and/or U.S. Diversified Real Estate ETF (“PPTY”) (each, a “Fund,” and collectively, the “Funds”) and, as a result, you have the right to vote on the Proposal and are entitled to be present at and to vote at the Special Meeting. Each share of a Fund is entitled to one vote on the applicable Proposal.

Q. What is the Proposal being considered at the Special Meeting?

A. You are being asked to vote on the following proposal(s):

PROPOSAL: | PROPOSAL: | For shareholders of each Fund, separately, to approve a new investment advisory agreement between the Trust, on behalf of such Fund, and Vident Advisory, LLC (d/b/a Vident Asset Management) (“VA” or the “Adviser”) (the “New Advisory Agreement”). No increase in shareholder fees or expenses is being proposed. |

Q. Will the Proposal affect the investments made by the Funds?

A. No. Approval of the Proposal by each Fund’s shareholders will not have any effect on the relevant Fund’s investment policies, strategies, and risks.

Q. Will the Proposal result in any change in the fees or expenses payable by the Funds?

A. No. Approval of the Proposal by each Fund’s shareholders will not affect the fees or expenses payable by each Fund. If the New Advisory Agreement is approved by each Fund’s shareholders, each Fund will pay VA a management fee equal to the management fee currently being paid by such Fund to VA.

Q. Why am I being asked to approve a new investment advisory agreement with VA?

A. Pursuant to a purchase agreement signed on March 24, 2023, Vident Capital Holdings, LLC, a subsidiary of MM VAM, LLC(“VA Holdings”), is expected to acquire a majority interest in VA on or around June 30, 2023 (the “Transaction”). MM VAM, LLC is an entity controlled by Casey Crawford. As of the Closing Date, Mr. Crawford will effectively control VA. The Transaction is expected to be completed on or around June 30, 2023 (the “Closing Date”), subject to the satisfaction of customary closing conditions, including obtaining necessary Fund and client consents and receipt of customary regulatory approvals. The Transaction will constitute an “assignment” under the Investment Company Act of 1940, as amended (the “1940 Act”), which will result in the automatic termination of the current investment advisory agreement between the Trust, on behalf of the Funds, and VA and the current investment sub-advisory agreement among the Trust, on behalf of the Funds, VA and Vident Investment Advisory, LLC (“VIA”). On the Closing Date, VIA will no longer serve as sub-adviser to the Funds and VA will perform all portfolio management and trading responsibility on behalf of the Funds.

To enable VA to continue serving as investment adviser to the Funds after the close of the Transaction, at a meeting of the Board held on April 20, 2023, the Board, including a majority of the Trustees who are not “interested persons” (as that term is defined in the 1940 Act (the “Independent Trustees”), approved a new investment advisory agreement between the Trust, on behalf of the Funds, and the Adviser. Under the 1940 Act, the approval of the Funds’ new investment advisory agreement also requires the affirmative vote of a “majority of the outstanding voting securities” of each Fund.

If a Fund’s shareholders approve the New Advisory Agreement, VA will continue to serve as the Funds’ investment adviser effective upon the closing of the Transaction.

Q. Why am I not being asked to approve a new investment sub-advisory agreement with VIA?

A. At the Closing Date, VIA will seek to move all its current personnel and clients to VA and wind down operations. For this reason, you are not being asked to approve a new sub-advisory agreement with VIA.

Q. Will there be any changes in the services provided to the Funds under the new agreements?

A. Yes. Under the New Advisory Agreement, not only will VA continue to have overall responsibility for the general management and administration of the Funds, but it will also assume all of the responsibilities that were previously assumed by VIA (e.g., day-to-day portfolio management and services such as buying and selling portfolio securities for each Fund).

Q. Will there be any changes to the portfolio management team for any of the Funds?

A. No. The portfolio management team for each Fund will not change if shareholders of a Fund approve the Proposal.

Q. What will happen if Funda Fund’s shareholders do not approve the Proposal?

A. The Transaction is subject to customary closing conditions, including obtainingconditions. One condition is that VA must obtain the approval of a certain numberpercentage of client accounts for closing to take place. As closing is not predicated on a single fund it is possible that the new agreements by the Board of Trustees of the Trust and shareholders of each applicable Fund.Transaction could close without a Funds approval. In the event a Fund is not able to obtain shareholder approval prior to the Closing Date, the Board, including a majority of the Independent Trustees, also approved an interim investment advisory agreement (the “Interim Advisory Agreement”) between the Trust on behalf of the Fund and VA, so that VA could continue managing the Fund after the change of control. Pursuant to Rule 15a‑15a‑4 under the 1940 Act, the Interim Investment Advisory Agreement will allow the Fund an additional 150 days to obtain shareholder approval of the New Advisory Agreement. The terms of the Interim Investment Advisory Agreement are substantially identical to the terms of the prior investment advisory agreement and prior sub-advisory agreement, except for the term and escrow provisions, and the addition of the sub-advisory services set forth in the prior sub-advisory agreement. Additionally, under the Interim Investment Advisory Agreement, management fees earned by VA would be held in an interest-bearing escrow account until shareholders approve the New Advisory Agreement with VA with respect to its Fund. Shareholder approval would need to be obtained within 150 days from the Closing Date.

If a Fund’s shareholders do not approve the New Investment Advisory Agreement, then the Board will have to consider other alternatives for the Fund upon the expiration of the prior advisory agreement and Interim Investment Advisory Agreement. TheAs a result of the Transaction the Current Advisory and Sub-Advisory Agreement will automatically terminate at the close of the Transaction. In such a situation, the Board willwould take such action as it deems necessary and in the best interests of each Fund and its respective shareholders, which may include further solicitation of that Fund’s shareholders with respect to the Proposal, solicitation of the approval of a different Proposal, or the liquidation of one or more Funds.

Q. How does the Board recommend that I vote in connection with the Proposal?

A. The Board recommends that you vote “FOR” the approval of the Proposal described in the Proxy Statement.

OTHER MATTERS

Q. Will my Fund(s) pay for this proxy solicitation?

A. No. VA or its affiliates will pay for the costs of this proxy solicitation, including the printing and mailing of the Proxy Statement and related materials. Under the terms of the Transaction, VA Holdings has agreed to reimburse VA for certain expenses related to obtaining new advisory agreements for each Fund.

Q. How can I vote my shares?

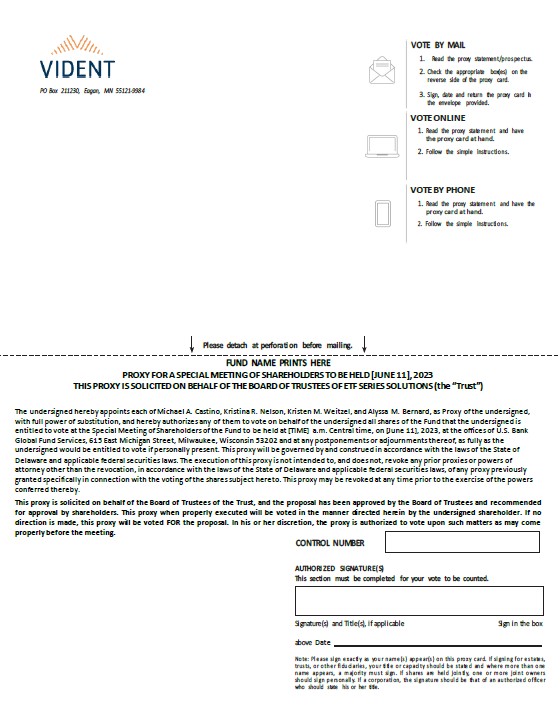

A. For your convenience, there are several ways you can vote:

By Mail: Complete, sign and return the enclosed proxy card(s) in the enclosed self-addressed, postage-paid envelope;

By Telephone: Call the number printed on the enclosed proxy card(s) and use the control number provided;

By Internet: Access the website address printed on the enclosed proxy card(s) and use the control number provided; or

In Person: Attend the Special Meeting as described in the Proxy Statement.

We intend to hold the Special Meeting in person. However, we are sensitive to the public health and travel concerns our shareholders may have and recommendations that public health officials may issue in light of the evolving COVID-19 pandemic. As a result, we may impose additional procedures or limitations on Special Meeting attendees or may decide to hold the Special Meeting in a different location or solely by means of remote communication. We plan to announce any such updates on our proxy website www.proxyvote.com,www.videntam.com, and we encourage you to check this website prior to the Special Meeting if you plan to attend. We also encourage you to consider your options to vote by internet, telephone, or mail, as discussed above, in advance of the Special Meeting in the event that, as of [JUNE 9],June 9, 2023, in-person attendance at the Special Meeting is either prohibited under a federal, state, or local order or contrary to the advice of public health care officials.

Q. How may I revoke my proxy?

A. Any proxy may be revoked at any time prior to its use by written notification received by the Trust’s Secretary, by the execution and delivery of a later-dated proxy, or by attending the Special Meeting and voting in person. Shareholders whose shares are held in “street name” through their broker will need to obtain a legal proxy from their broker and present it at the Special Meeting in order to vote in person. Any letter of revocation or later-dated proxy must be received by the appropriate Fund prior to the Special Meeting and must indicate your name and account number to be effective. Proxies voted by telephone or Internet may be revoked at any time before they are voted at the Special Meeting in the same manner that proxies voted by mail may be revoked.

Q. What vote is required to approve the Proposal?

A. The New Advisory Agreement must be approved by a vote of a majority of the outstanding voting securities of a Fund. The “vote of the majority of the outstanding voting securities” is defined in the 1940 Act as the lesser of the vote of (i) 67% or more of the voting securities of the applicable Fund present at the Special Meeting or represented by proxy if holders of more than 50% of such Fund’s outstanding voting securities are present or represented by proxy; or (ii) more than 50% of the outstanding voting securities of the applicable Fund.

Q. Where can I obtain additional information about this Proxy Statement?

A. If you need any assistance, or have any questions regarding the Proposal or how to vote your shares, please call our proxy solicitor, Morrow Sodali Fund Solutions, LLC, at 866-839-1852. Representatives are available to assist you Monday through Friday, 9:00 a.m. to 10:00 p.m. Eastern time.

VIDENT U.S. BOND STRATEGY ETF™ (VBND)

VIDENT U.S. EQUITY STRATEGY ETF™ (VUSE)

VIDENT INTERNATIONAL EQUITY STRATEGY ETF™ (VIDI)

U.S. DIVERSIFIED REAL ESTATE ETF (PPTY)

each a series of ETF Series Solutions

615 East Michigan Street

Milwaukee, Wisconsin 53202

PROXY STATEMENT xx,May 15, 2023

|

This Proxy Statement is being furnished to the shareholders of Vident U.S. Bond Strategy ETF™, Vident U.S. Equity Strategy ETF™, Vident International Equity Strategy ETF™, and U.S. Diversified Real Estate ETF (each, a “Fund,” and collectively, the “Funds”), each a series of ETF Series Solutions (the “Trust”), an open-end management investment company, on behalf of the Trust’s Board of Trustees (the “Board”) in connection with each Fund’s solicitation of its shareholders’ proxies for use at a special meeting of shareholders of the Funds (the “Special Meeting”) to be held on [JUNE 9],June 9, 2023, at [TIME]11:00 a.m. Central time at the offices of the Funds’ administrator, U.S. Bank Global Fund Services, 615 East Michigan Street, Milwaukee, Wisconsin 53202, for the purposes set forth below and in the accompanying Notice of Special Meeting.

Shareholders of record at the close of business on the record date, established as May 9, 2023 established as the Record Date, May 9, 2023,(the “Record Date”), are entitled to notice of, and to vote at, the Special Meeting. The approximate mailing date of this Proxy Statement and the enclosed proxy card(s) to shareholders is [MAILING DATE, 2023].May 16, 2023. The Special Meeting will be held to obtain shareholder approval for the following Proposal (the “Proposal”):

PROPOSAL: | PROPOSAL: | For shareholders of each Fund, separately, to approve a new investment advisory agreement between the Trust, on behalf of such Fund, and Vident Advisory, LLC (d/b/a Vident Asset Management) (“VA” or the “Adviser”) (the “New Advisory Agreement”). No increase in shareholder fees or expenses is being proposed. |

At your request, the Trust will send you a free copy of the most recent audited annual report for the relevant Fund or its current prospectus and statement of additional information (“SAI”). Please call the Funds at 1-800-617-0004 or write to the Funds, c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, Wisconsin 53201-0701, to request an annual report, prospectus, or SAI, or with any questions you may have relating to this Proxy Statement.

Background. VA, the Funds’ current investment adviser, located at 1125 Sanctuary Parkway, Suite 515, Alpharetta, Georgia 30009, is an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”) and has provided investment advisory services to the Funds since 2019.

Pursuant to a sub-advisory agreement, Vident Investment Advisory, LLC, (“VIA”) located at 1125 Sanctuary Parkway, Suite 515, Alpharetta, Georgia 30009, is responsible for trading portfolio securities on behalf of each Fund, including selecting broker-dealers to execute purchase and sale transactions as instructed by the Adviser or in connection with any rebalancing or reconstitution of a Fund’s respective Index, subject to the supervision of the Adviser and the Board. VIA has provided investment advisory services to the Vident U.S. Bond Strategy ETF™ (“VBND”) since April 15, 2015, Vident U.S. Equity Strategy ETF™ (“VUSE”) since December 9, 2014, Vident International Equity Strategy ETF™ (“VIDI”) since April 8, 2015, and U.S. Diversified Real Estate ETF since inception on March 27, 2018.

VA was formed in 2016 and commenced operations and registered with the SEC as an investment adviser in 2019, and is a wholly-owned subsidiary of Vident Financial, LLC (“Vident Financial”). VIA was formed in 2014 and provides investment advisory services to ETFs, including the Funds. VIA is also a wholly-owned subsidiary of Vident Financial. Vident Financial was formed in 2013 to develop and license investment market solutions (indices and funds) based on strategies that combine sophisticated risk-balancing methodologies, economic freedom metrics, valuation, and investor behavior. Vident Financial is a wholly-owned subsidiary of the Vident Investors’ Oversight Trust. Vince L. Birley, Mohammad Baki, and W. Baker Crow serve as the trustees of the Vident Investors’ Oversight Trust.

Pursuant to a purchase agreement signed on March 24, 2023, Vident Capital Holdings, LLC, a subsidiary of MM VAM, LLC is expected to acquire VA (the “Transaction”). MM VAM, LLC is an entity controlled by Casey Crawford. The Transaction is expected to be completed on or around June 30, 2023 (the “Closing Date”), subject to the satisfaction of customary closing conditions, including obtaining certain Fund and client consents and receipt of customary regulatory approvals. As of the Closing Date, Mr. Crawford will effectively control VA. Pursuant to the Investment Company Act of 1940, as amended (the “1940 Act”), the investment advisory agreement between the Trust, on behalf of the Funds and VA (the “Current Advisory Agreement”) will automatically terminate on the Closing Date. The Current Sub-Advisory Agreement among the Adviser, VIA, and the Trust, on behalf of the Funds (the “Current VIA Sub-Advisory Agreement”) will also automatically terminate on the Closing Date.

At a meeting of the Board, held on April 20, 2023 (the “Meeting”), the Adviser requested, and the Board, including a majority of the Trustees who are not interested persons of the Trust (as defined by the 1940 Act) (the “Independent Trustees”), approved (i) a new investment advisory agreement between the Trust, on behalf of the Funds, and the Adviser (the “New Advisory Agreement”); and (ii) an interim advisory agreement between the Trust, on behalf of the Funds, and the Adviser (the “Interim Agreement”).

Under the 1940 Act, the approval of the New Advisory Agreement requires the affirmative vote of a “majority of the outstanding voting securities” of each applicable Fund. The “vote of the holders of a majority of the outstanding voting securities” is defined in the 1940 Act as the lesser of the vote of shareholders holding (i) 67% or more of the voting securities of a Fund present at the Special Meeting or represented by proxy if holders of more than 50% of such Fund’s outstanding voting securities are present or represented by proxy; or (ii) more than 50% of the outstanding voting securities of a Fund. Shareholders will have equal voting rights (i.e., one vote per share). Abstentions and “broker non-votes” (i.e., shares held by brokers or nominees as to which (i) instructions have not been received from the beneficial owner or the persons entitled to vote and (ii) the broker does not have discretionary voting power on a particular matter) will have the same effect as votes against the Proposal. Accordingly, you are being asked to approve the New Advisory Agreement.

The Board believes the Proposal is in the best interests of each Fund and its shareholders and recommends that you vote “FOR” the Proposal. Importantly, approval of the Proposal will not result in any increase in shareholder fees or expenses.

PROPOSAL: APPROVAL OF NEW INVESTMENT ADVISORY AGREEMENT

The Adviser, located at 1125 Sanctuary Parkway, Suite 515, Alpharetta, Georgia 30009, is a registered investment adviser that, as of the Closing Date, provides portfolio management services to separately managed accounts, ETFs, and the Funds. As part of the Transaction the Adviser will assume all responsibilities of VIA. The Adviser will be responsible for trading portfolio securities on behalf of each Fund, including selecting broker-dealers to execute purchase and sale transactions or in connection with any rebalancing or reconstitution of a Fund’s respective Index, subject to the supervision of the Board.

At the Meeting, the Board, including the majority of the Independent Trustees, determined that the approval of VA to continue serving as the Funds’ investment adviser, and assume all duties of VIA, the current sub-adviser, was in the best interest of each Fund and its respective shareholders, approved the New Advisory Agreement, and recommended that it be submitted to the Funds’ shareholders for approval.

The Current Advisory Agreement was most recently approved by the Board, including a majority of the Independent Trustees, on January 11-12, 2023, and by the shareholders of each Fund on March 28, 2019.

The Current Advisory Agreement and Current Sub-Advisory Agreement are collectively materially identical to the New Advisory Agreement in all material respects, except for their effective and termination dates.

If the Proposal is approved by a Fund’s shareholders, the New Advisory Agreement is expected to become effective upon the closing of the Transaction. The Transaction is subject to customary closing conditions, including obtaining approval of a certain number of the new agreements by the Board of Trustees of the Trust and shareholders of each applicable Fund. If the shareholders of a Fund do not approve the Proposal at the Special Meeting, it is possible that a condition to the closing of the Transaction will not be satisfied and VA will continue to serve as the investment adviser to each Fund and VIA will continue to serve as the investment sub-adviser to each Fund pursuant to the Current Advisory Agreement and Current Sub-Advisory Agreement, respectively. Accordingly, if the Proposal is not approved by a Fund’s shareholders, as applicable, at the Special Meeting, the Board will take such action as it deems necessary and in the best interests of the Fund and its shareholders, which may include further solicitation of a Fund’s shareholders with respect to the Proposal, solicitation of the approval of a different Proposal, or the liquidation of one or more Funds.

Summary of the New Advisory Agreement. A copy of the form of New Advisory Agreement is attached to this Proxy Statement as Exhibit A. The following description of the material terms of the New Advisory Agreement is only a summary and is qualified in its entirety by reference to Exhibit A. References to the “Current Agreements” is inclusive of the Current Advisory Agreement and Current Sub-Advisory Agreement.

majority

Duration and Termination. The New Advisory Agreement, like the Current Advisory Agreement, will remain in effect for an initial period of two years, unless sooner terminated. After the initial two-year period, continuation of the New Advisory Agreement from year to year is subject to annual approval by the Board, including at least a majority of the Independent Trustees.

Both the Current Advisory Agreement and the New Advisory Agreement may be terminated without penalty (i) by vote of a majority of the Board, (ii) by vote of a majority of the outstanding voting securities of the Fund, or (iii) by the Adviser upon one-hundred twenty (120) days’ written notice to the Trust.

Advisory Services. The Current Advisory Agreement and the New Advisory Agreement require that the Adviser regularly provide each Fund with investment research, advice and supervision and continuously furnish an investment program for the Funds, consistent with the respective investment objectives and policies of each Fund. Under the Current Agreements, the Adviser is responsible for determining each Fund’s assets to be purchased or sold by the Fund and has the authority to select and retain a sub-adviser to perform some or all of the services for which the Adviser is responsible. In addition, the New Advisory Agreement requires the Adviser to perform services set forth in the Current Sub-Advisory Agreement, such as determining the portfolio assets to be purchased or sold by a Fund, in accordance with such Fund’s investment objective, guidelines, policies and restrictions, and selecting broker-dealers to execute purchase and sale transactions, subject to the supervision of the Adviser and the Board.

Management Fees. Each Fund’s advisory fee will not change as a result of the approval of the Proposal. Both the Current Advisory Agreement and the New Advisory Agreement provide that for the services VA provides to the Funds, each Fund pays VA a unified management fee, which is calculated daily and paid monthly, at an annual rate based on the applicable Fund’s average daily net assets as set forth in the table below. For each Fund’s most recent fiscal year (ended August 31, 2022 for VBND, VUSE, and VIDI and ended February 28, 2023 for PPTY) each Fund paid advisory fees under the Current Advisory Agreement as set forth in the table below.

| Name of Fund | Management Fee | Advisory Fees paid by each Fund to the Adviser | Advisory Fees Paid by each Fund to the Adviser | Management Fee | Advisory Fees paid by each Fund to the Adviser | Advisory Fees Paid by each Fund to the Adviser |

| Vident U.S. Bond Strategy ETF™ | 0.41% | 0.41% | $1,626,266 | 0.41% | 0.41% | $1,626,266 |

| Vident U.S. Equity Strategy ETF™ | 0.50% | 0.50% | $2,285,277 | 0.50% | 0.50% | $2,285,277 |

| Vident International Equity Strategy ETF™ | 0.61% | 0.61% | $2,549,776 | 0.61% | 0.61% | $2,549,776 |

| U.S. Diversified Real Estate ETF | 0.53% | 0.49% | $631,6801 | 0.53% | 0.49% | $631,6801 |

1Vident Advisory, LLC contractually agreed to waive four basis points (0.04%) of its unified management fee until June 30, 2023. The fee waiver agreement will automatically terminate on June 30, 2023. Without the fee waiver total fees would have been $683,246.

Brokerage Policies. The Current Agreements and the New Advisory Agreement authorize the Funds’ Adviser to select the brokers or dealers that will execute the purchases and sales of securities of the Funds and direct the Adviser to seek for each Fund the most favorable execution and net price available under the circumstances. The Adviser may cause a Fund to pay a broker a commission more than that which another broker might have charged for effecting the same transaction, in recognition of the value of the brokerage and research and other services provided by the broker to the Adviser.

The table below shows brokerage commissions paid in the aggregate amount by each Fund for its most recent fiscal year (ended August 31, 2022 for VBND, VUSE, and VIDI and ended February 28, 2023 for PPTY).

| Name of Fund | FYE $ |

| Vident U.S. Bond Strategy ETF™ | $0 |

| Vident U.S. Equity Strategy ETF™ | $234,849 |

| Vident International Equity Strategy ETF™ | $358,647 |

| U.S. Diversified Real Estate ETF | $XX44,359 |

During its most recent fiscal year no Fund paid brokerage commissions to any registered broker-dealer affiliates of the Funds or the Adviser. The Funds did not hold any securities of “regular broker dealers” as of its most recent fiscal year end.

Payment of Expenses. Both the Current Advisory Agreement and the New Advisory Agreement provide that the Adviser will pay all of the costs and expenses incurred by it in connection with the advisory services provided for the Funds. The Adviser will not be required to pay the costs and expenses associated with purchasing securities, commodities, and other investments for the Funds (including brokerage commissions and other transaction or custodial charges). Additionally, both the Current Advisory Agreement and the New Advisory Agreement state that the Adviser agrees to pay all expenses incurred by the Funds except for the fee paid to the Adviser pursuant to this Agreement, interest charges on any borrowings, dividends and other expenses on securities sold short, taxes, brokerage commissions and other expenses incurred in placing orders for the purchase and sale of securities and other investment instruments, acquired fund fees and expenses, accrued deferred tax liability, extraordinary expenses, and distribution fees and expenses paid by the Trust under any distribution plan adopted pursuant to Rule 12b-1 under the 1940 Act.

Other Provisions. Both the Current Advisory Agreement and the New Advisory Agreement provide that the Adviser shall indemnify and hold harmless the Trust and all affiliated persons (within the meaning of Section 2(a)(3) of the 1940 Act) and all controlling persons (as described in Section 15 of the Securities Act of 1933, as amended (the “1933 Act”)) thereof (collectively, the “Trust Indemnitees”) against any and all losses, claims, damages, liabilities or litigation to the extent that a Trust Indemnitee incurs actual losses, damages, or liabilities (including reasonable legal and other expenses) by reason of or arising out of the Adviser’s willful misfeasance, bad faith, or gross negligence in the performance of its duties under the agreement or its reckless disregard of its obligations and duties under the agreement.

Portfolio Managers. Austin Wen, CFA, Portfolio Manager for VIA, and Rafael Zayas, CFA, SVP, Head of Portfolio Management and Trading for VIA, and Ryan Dofflemeyer, Senior Portfolio Manager for VIA, are jointly responsible for the day-to-day management of VUSE, VIDI, PPTY, and under the Current VIA Sub-Advisory Agreement, and upon shareholder approval of Proposal 2,PPTY. Messrs. Wen, Zayas, and ZayasDofflemyer will continuecontine to be responsible for the management of VUSE, VIDI, and PPTY after the portfolios for such Funds.close of the Transaction.

Jeff Kernagis, CFA, Senior Portfolio Manager for VIA, and Jim Iredale, CFA, Senior Portfolio Manager for VIA, are jointly responsible for the day-to-day management of VBND, and under the Current VIA Sub-Advisory Agreement, and upon shareholder approval of Proposal 2,VBND. Messrs. Kernagis and Iredale will continue to be responsible for the management of VBND after the portfoliosclose of such Funds.the Transaction.

Mr. Wen serves as Portfolio Manager for VIA. Mr. Wen has been a Portfolio Manager of VIA since 2016 and has over eight years of investment management experience. His focus at VIA is on portfolio management and trading, risk monitoring and investment analysis. Previously, he was an analyst for Vident Financia,Financial, beginning in 2014, working on the development and review of investment solutions. He began his career in 2011 as a State Examiner for the Georgia Department of Banking and Finance. Mr. Wen obtained a BA in Finance from the University of Georgia and holds the Chartered Financial Analyst (“CFA”) designation.

Mr. Zayas serves as Portfolio Manager for VIA. Mr. Zayas has over 15 years of trading and portfolio management experience in global equity products and ETFs. He is SVP, Head of Portfolio Management and Trading. Mr. Zayas specializes in managing and trading of developed, emerging, and frontier market portfolios. Prior to joining VIA in 2017, he was a Portfolio Manager at Russell Investments for over $5 billion in quantitative strategies across global markets, including emerging, developed, and frontier markets and listed alternatives. Before that, he was an equity Portfolio Manager at BNY Mellon Asset Management, where he was responsible for $150 million in internationally listed global equity ETFs and assisted in managing $3 billion of global ETF assets. Mr. Zayas holds a BS in Electrical Engineering from Cornell University. He also holds the Chartered Financial Analyst designation.

Mr. Dofflemeyer serves as Portfolio Manager for VIA. Mr. Dofflemeyer has over 16 years of trading and portfolio management experience across various asset classes including both ETFs and mutual funds. He is Senior Portfolio Manager for VIA, specializing in managing and trading of global equity and multi-asset portfolios. Prior to joining VIA in August 2020, he was a Senior Portfolio Manager at ProShare Advisors LLC (“ProShare”) for over $3 billion in ETF assets across global equities, commodities, and volatility strategies. Mr. Dofflemeyer held various positions with ProShare from October 2003 until August 2020. From 2001 to 2003, he was a Research Analyst at the Investment Company Institute in Washington DC. Mr. Dofflemeyer holds a BA from the University of Virginia and an MBA from the University of Maryland.

Mr. Kernagis serves as a Portfolio Manager for VIA. Mr. Kernagis has 32 years of investment experience. Prior to joining VIA in 2022, Mr. Kernagis was a Senior Vice President at Northern Trust Asset Management. Before that, Mr. Kernagis spent almost 14 years at Invesco/PowerShares, whereas Senior Portfolio Manager he directed the fixed income ETF PM team and helped grow assets to $40 billion in bond ETFs globally. Mr. Kernagis was also a PM at Claymore (Guggenheim) Securities where he managed both equity ETFs and bond Unit Investment Trusts. In addition, he was a senior bond trader at Mid-States (Alloya) Corporate Federal Credit Union. Prior to working in investment management, Mr. Kernagis held institutional derivative sales positions at ABN Amro, Bear Stearns, and Prudential Securities. Mr. Kernagis earned a BBA degree from the University of Notre Dame and an MBA from DePaul University. He also holds the CFA designation.

Mr. Iredale serves as a Portfolio Manager for VIA. Mr. Iredale became a Senior Portfolio Manager – Fixed Income at VIA in 2015 and has over 15 years of experience managing fixed income products. Prior to joining VIA, Mr. Iredale was a Manager – Fixed Income with Ronald Blue & Co., one of the largest independent wealth management firms in the U.S., where he started in 1999. Mr. Iredale graduated with a BBA from the University of Georgia, Terry College of Business and obtained his JD from the University of Georgia School of Law. He holds the CFA designation.

Executive Officers and Directors of VA. Information regarding the principal executive officers and directors of VA is set forth below. The address of VA and its executive officers and directors is 1125 Sanctuary Parkway, Suite 515, Alpharetta, Georgia 30009. The following individuals are the executive officers and directors of VA:

| Name | Position with VA |

| Deborah Kimery | Chief Executive Officer |

| Erik Olsen | Chief Compliance Officer |

No Trustee or officer of the Trust currently holds any position with VA or its affiliated persons. No Trustee or officer of the Trust holds any position with Vident Capital Holdings, LLC or its affiliated persons.

Required Vote. Approval of the Proposal requires the affirmative “vote of the holders of a majority of the outstanding voting securities” of a Fund. Under the 1940 Act, the “vote of the holders of a majority of the outstanding voting securities” means the affirmative vote of the lesser of (a) 67% or more of the shares of a Fund present or represented by proxy at the Special Meeting if the holders of more than 50% of the outstanding shares are present or represented by proxy at the Special Meeting, or (b) more than 50% of the outstanding shares of a Fund. If the Proposal is approved by a Fund’s shareholders, the New Advisory Agreement is expected to become effective upon the closing of the Transaction. The Transaction is subject to customary closing conditions, including obtaining approval of a certain number of the new agreements by the Board of Trustees of the Trust and shareholders of each applicable Fund. If the shareholders of a Fund do not approve the Proposal at the Special Meeting, a condition to the closing of the Transaction may not be satisfied and VA will continue to serve as the investment adviser to the Fund and VIA will continue to serve as the investment sub-adviser to the Fund pursuant to the Current Advisory Agreement and Current Sub-Advisory Agreement. Accordingly, if the Proposal is not approved by each Fund’s shareholders, as applicable, at the Special Meeting, the Board will take such action as it deems necessary and in the best interests of each Fund and its respective shareholders, which may include further solicitation of a Fund’s shareholders with respect to the Proposal, solicitation of the approval of a different Proposal, or the liquidation of one or more Funds.

Recommendation of the Board of Trustees. The Board believes that the terms and conditions of the New Advisory Agreement are fair to, and in the best interests of, each Fund and its shareholders. The Board believes that, upon shareholder approval of the Proposal, the Adviser will provide at least the same level of services that it and its affiliate VIA currently provide each Fund under the Current Agreements. The Board was presented with information demonstrating that the New Advisory Agreement would enable the Funds’ shareholders to continue to obtain quality services at a cost that is fair and reasonable. At the Meeting, the Board, including all the Independent Trustees, approved the New Advisory Agreement and recommends that shareholders of each Fund approve the Proposal.

In considering the New Advisory Agreement, the Board focused on the effect that the Transaction could be expected to have on the Adviser’s business and operations as they relate to the Funds and also took into consideration (i) the nature, extent, and quality of the services provided, and to be provided, by VA; (ii) the historical performance of each Fund; (iii) the cost of the services provided and the profits realized by VA or its affiliates from services rendered to the Funds as well as the estimated cost of the services to be provided by VA and the profits expected to be realized by VA from providing such services, including any other financial benefits enjoyed by VA or its affiliates; (iv) comparative fee and expense data for the Funds and other investment companies with similar investment objectives, including a report prepared by Barrington Partners, an independent third party, that compares each Fund’s investment performance, fees and expenses to relevant market benchmarks and peer groups (the “Barrington Report”); (v) the extent to which any economies of scale realized by VA in connection with its services to the Funds are, or will be, shared with Fund shareholders; and (vi) other factors the Board deemed to be relevant.

The Board also considered that the Adviser and its affiliate VIA, along with other service providers of the Funds, had provided written and oral updates on the firm over the course of the year with respect to its role as investment adviser and sub-adviser to the Funds, and the Board considered that information alongside the written materials presented at the Meeting, as well as the quarterly Board meeting held on April 5-6, 2023, in its consideration of whether the New Advisory Agreement should be approved. In addition, the Board took into consideration performance and due diligence information related to VA, including the Barrington Report, that was provided to the Board in advance of its annual review of the Funds’ Current Advisory Agreement at its January 11-12, 2023 quarterly meeting. At both the Meeting and the April 5-6 meeting, representatives from VA provided an overview of the Transaction and the effect it would have on the management of the Funds. Representatives from the Adviser also provided an overview of the Funds’ strategies, the services provided to each Fund by the Adviser, and additional information about the Adviser’s personnel and business operations. Further, subsequent to the April 5-6 meeting, at the Board’s request, VA representatives provided additional information about the Transaction and discussed this information with Fund counsel prior to the Meeting. The Board then met with representatives of the Adviser at the Meeting to further discuss the Transaction and the additional information the Adviser had provided. The Adviser confirmed that the Transaction would not result in changes to Funds’ fees and expenses or the nature, extent and quality of services provided to the Funds, including their day-to-day management, or the personnel providing these services. The Board then discussed the materials and the Adviser’s oral presentations that the Board had received and any other information that the Board received at the Meeting and at prior meetings, and deliberated on the approval of the New Advisory Agreement in light of this information. In its deliberations, the Board did not identify any single piece of information discussed below that was all-important or controlling.

Nature, Extent, and Quality of Services Provided. The Trustees considered the scope of services provided under the New Advisory Agreement, noting that the Adviser had provided and would continue to provide investment management services to the Funds. The Trustees also considered that the services to be provided under the New Advisory Agreement were identical in all material respects to those services provided under the Current Agreements. The Trustees noted that although VIA will cease to exist upon the close of the Transaction, VIA personnel will become Adviser personnel at such time and continue to provide services to the Funds on behalf of the Adviser. In considering the nature, extent, and quality of the services provided by the Adviser, the Board considered the quality of the Adviser’s compliance program and past reports from the Trust’s Chief Compliance Officer (“CCO”) regarding the CCO’s review of the Adviser’s compliance program. The Board also considered its previous experience with the Adviser providing investment management services to the Funds. The Board noted that it had received a copy of the Adviser’s registration form and financial statements, as well as the Adviser’s response to a detailed series of questions that included, among other things, information about the Adviser’s decision-making process, the background and experience of the firm’s key personnel, and the firm’s compliance policies, marketing practices, and brokerage information. The Board also considered the Adviser’s statements that the scope and quality of services provided to the Funds by the Adviser would not diminish as a result of the Transaction.

The Board also considered other services provided by the Adviser to the Funds, monitoring each Fund’s adherence to its investment restrictions and compliance with the Funds’ policies and procedures and applicable securities regulations, as well as monitoring the extent to which a Fund achieves its investment objective as a passively managed fund. Additionally, the Board considered that each Fund tracks an index created and owned by an affiliate of the Adviser. The Board noted the Adviser’s belief that shareholders invest in a Fund based on the investment principles incorporated into the index methodology of such Fund and the expectation that the Adviser will provide advisory services to such Fund based on its index methodology.

Historical Performance. The Trustees next considered each Fund’s performance, noting that it had recently undertaken a comprehensive review of such matters at its January 11-12, 2023 meeting. The Board observed that information regarding each Fund’s past investment performance, for periods ended September 30, 2022, had been included in the written materials previously provided to the Board, including the Barrington Report, which compared the performance results of each Fund with the returns of a group of ETFs selected by Barrington Partners as most comparable (the “Peer Group”) as well as with funds in each Fund’s Morningstar category – US Fund Real Estate, US Fund Intermediate Core-Plus Bond, US Fund Foreign Large Value, and US Fund Mid-Cap Value, respectively (each, a “Category Peer Group”). Additionally, at the Board’s request, the Adviser identified the funds the Adviser considered to be each Fund’s most direct competitors (each, a “Selected Peer Group”) and provided the Selected Peer Group’s performance results.

In addition, the Board noted that, for each applicable period ended September 30, 2022, each Fund’s performance on a gross of fees basis (i.e., excluding the effect of fees and expenses on Fund performance) was generally consistent with the performance of its underlying index, indicating that each Fund tracked its underlying index closely and in an appropriate manner.

U.S. Diversified Real Estate ETF: The Board noted that the Fund underperformed its broad-based benchmark, the MSCI US REIT Gross Index, for each of the one-year, three-year, and since inception periods. The MSCI US REIT Gross Index provides an indication of the performance of the U.S. REIT market. In comparing the Fund’s performance to that of the benchmark, the Board noted that the Fund, unlike its benchmark, screens out companies that are externally managed and companies that derive at least 85% of their income from ownership or management of real property.

The Board then noted that, for the one-year, three-year, and since inception periods ended September 30, 2022, the Fund outperformed the median return of its Peer Group, but the Fund only outperformed the median return of its Category Peer Group over the since inception period. The Board took into consideration that the Peer Group includes a mix of U.S. real estate and global real estate ETFs. The Board also noted that the Fund generally performed within the range of funds in the Selected Peer Group for the one-year and three-year periods ended September 30, 2022. The Board considered that the funds included in the Selected Peer Group were described by the Adviser as funds with a similar investment universe, investment exposure, REIT sector exposure, and number of holdings.

Vident U.S. Bond Strategy ETF: The Board noted that the Fund underperformed its broad-based benchmark, the FTSE Broad Investment Grade Bond Index, for the one-year, three-year, five-year, and since inception periods. The FTSE Broad Investment Grade Bond Index tracks the performance of the U.S. Dollar-denominated bonds issued in the U.S. investment-grade bond market. In comparing the Fund’s performance to that of the benchmark, the Board noted that the Fund provides more diversified exposure to the U.S. bond market, including exposure to non-investment grade bonds excluded from the benchmark.

The Board then noted that, for the one-year, three-year, five-year, and since inception periods ended September 30, 2022, the Fund slightly underperformed the median return of its Peer Group and Category Peer Group. The Board took into consideration that only a small percentage of the ETFs in the Peer Group have the flexibility, like the Fund, to invest in non-core fixed income sectors, such as high-yield corporate bonds (also known as “junk bonds”) and Treasury Inflation-Protected Securities (“TIPS”). The Board also noted that the Fund generally performed within the range of funds in the Selected Peer Group for the one-year, three-year and five-year periods ended September 30, 2022. The Board considered that the funds included in the Selected Peer Group were described by the Adviser as funds with similar objectives, investment universes, sector exposure, and average maturity.

Vident International Equity Strategy ETF: The Board noted that the Fund outperformed its broad-based benchmark, the Morningstar Global Markets ex-US Index, for the one-year period ended September 30, 2022, but the Fund underperformed its benchmark for each of the three-year, five-year, and since inception periods. The Morningstar Global Markets ex-US Index provides exposure to the top 97% market capitalization in each of two economic segments, developed markets, excluding the United States, and emerging markets. In comparing the Fund’s performance to that of the benchmark, the Board noted that the Fund, unlike the benchmark, invests in companies in emerging markets.

The Board noted that, for the one-year, three-year, five-year and since inception periods ended September 30, 2022, the Fund underperformed the median return of its Category Peer Group, but slightly outperformed its Peer Group over the one-year and three-year periods. The Board also noted that the Fund generally performed within the range of funds in the Selected Peer Group for the one-year and five-year periods and outperformed all of the funds from the Selected Peer Group over the three-year period ended September 30, 2022. The Board considered that the funds included in the Selected Peer Group were described by the Adviser as funds with similar objectives, investment universes, and average market capitalizations.

Vident U.S. Equity Strategy ETF: The Board noted that the Fund outperformed its broad-based benchmark, the Morningstar U.S. Market Total Return Index, for the one-year and three-year periods ended September 30, 2022, but the Fund underperformed this benchmark for the five-year and since inception periods. With respect to the Fund’s second benchmark, the S&P 500, the Board noted that the Fund outperformed the S&P 500 for the one-year period, but the Fund underperformed the S&P 500 for the three-year, five-year, and since inception periods. The Morningstar U.S. Market Total Return Index measures the performance of U.S. securities and targets 97% market capitalization coverage of the investable universe. The S&P 500 Index provides an indication of the performance of U.S. large-cap companies

The Board noted that, for the one-year and three-year periods ended September 30, 2022, the Fund outperformed the median return of its Peer Group, and the Fund outperformed the median return of its Category Peer Group over the three-year, five-year, and since inception periods. The Board also noted that the Fund generally performed within the range of funds in the Selected Peer Group for the one-year, three-year, and five-year periods ended September 30, 2022. The Board considered that the funds included in the Selected Peer Group were described by the Adviser as funds with similar objectives, investment universes, and quantitative approaches to security selection.

Cost of Services Provided and Economies of Scale. The Board observed that the Transaction would not result in an increase in the level of the advisory fee paid by each Fund to the Adviser. In this regard, the Board reviewed each Fund’s fees and expenses, noting that the advisory fees to be paid to the Adviser for its services to the Funds under the New Advisory Agreement were identical to those in the Current Advisory Agreement. In addition, the Board took into consideration that the Adviser had charged, and would continue to charge, a “unified fee,” meaning each Fund pays no expenses other than the advisory fee and, if applicable, certain other costs such as interest, brokerage, acquired fund fees and expenses, extraordinary expenses, and, to the extent it is implemented, fees pursuant to a Distribution and/or Shareholder Servicing (12b‑(12b‑1) Plan. The Board noted that the Adviser had been and would continue to be responsible for compensating the Trust’s other service providers and paying the Funds’ other expenses out of the Adviser’s own fee and resources.

The Board noted that each Fund’s net expense ratio was equal to its unified fee (described above), except that the U.S. Diversified Real Estate ETF has a fee waiver of four basis points and, as a result, its net expense ratio is less than its unified fee. The fee waiver would terminate effective June 30, 2023. The Board took into consideration that it had recently evaluated a comparison of each Fund’s net expense ratio to its Peer Group and Category Peer Group, as shown in the Barrington Report, and its Selected Peer Group.

U.S. Diversified Real Estate ETF: The Board noted that the Fund’s net expense ratio was higher than the median net expense ratio, but within the range, of the funds in the Peer Group and lower than the median net expense ratio of funds in the Category Peer Group. In addition, the Board noted that the Fund’s net expense ratio was within the range of net expense ratios of funds in its Selected Peer Group.

Vident U.S. Bond Strategy ETF: The Board noted that the Fund’s net expense ratio was higher than the median net expense ratio, but within the range, of the funds in the Peer Group and lower than the median net expense ratio of funds in the Category Peer Group. In addition, the Board noted that the Fund’s net expense ratio was within the range of net expense ratios of funds in its Selected Peer Group.

Vident International Equity Strategy ETF: The Board noted that the Fund’s net expense ratio was higher than the median net expense ratio, but within the range, of the funds in the Peer Group and lower than the median net expense ratio of funds in the Category Peer Group. In addition, the Board noted that the Fund’s net expense ratio was slightly higher than the highest net expense ratio of the other funds in its Selected Peer Group.

Vident U.S. Equity Strategy ETF: The Board noted that the Fund’s net expense ratio was higher than the median net expense ratio, but within the range, of the funds in the Peer Group and lower than the median net expense ratio of funds in the Category Peer Group. In addition, the Board noted that the Fund’s net expense ratio was within the range of net expense ratios of funds in its Selected Peer Group.

The Board then considered the Adviser’s financial resources and information regarding the Adviser’s ability to support its management of the Funds and obligations under the unified fee arrangement, noting that the Adviser had provided its financial statements for the Board’s review. The Board also evaluated the compensation and benefits received, and expected to be received, by the Adviser from its relationship with the Funds, taking into account an analysis of the Adviser’s profitability, and expected profitability, with respect to each Fund at various actual and projected Fund asset levels. In evaluating these matters, the Board considered the resources that would become available to the Adviser as a result of the Transaction.

The Board expressed the view that it currently appeared that the Adviser might realize economies of scale in managing the Funds as assets grow in size. The Board noted that, should the Adviser realize economies of scale in the future, the Board would evaluate whether those economies were appropriately shared with Fund shareholders, whether through the structure and amount of the fee or by other means.

Conclusion. No single factor was determinative of the Board’s decision to approve the New Advisory Agreement; rather, the Board based its determination on the total mix of information available to it. Based on a consideration of all the factors in their totality, the Board, including the Independent Trustees, determined that the New Advisory Agreement, including the compensation payable under the agreement, was fair and reasonable to each Fund. The Board, including the Independent Trustees, determined that the approval of the New Advisory Agreement was in the best interests of each Fund and its shareholders.

Expenses Related to the Proposal. All expenses associated with the Proposal will be borne by the Adviser or its affiliates and not by the Funds.

THE BOARD RECOMMENDS THAT SHAREHOLDERS OF EACH FUND VOTE “FOR” THE PROPOSAL.

OTHER INFORMATION

Section 15(f) of the 1940 Act. Because the Transaction may be considered to result in a change of control of the Adviser under the 1940 Act resulting in the assignment of the Former Advisory Agreement, the Adviser intends for the Transaction to come within the safe harbor provided by Section 15(f) of the 1940 Act, which permits an investment adviser of a registered investment company (or any affiliated persons of the investment adviser) to receive any amount or benefit in connection with a sale of an interest in the investment adviser that results in an assignment of an investment advisory contract, provided that the following two conditions are satisfied.

First, an “unfair burden” may not be imposed on the investment company as a result of the sale of the interest, or any express or implied terms, conditions or understandings applicable to the sale of the interest. The term “unfair burden,” as defined in the 1940 Act, includes any arrangement during the two-year period following the transaction whereby the investment adviser (or predecessor or successor adviser), or any “interested person” of the adviser (as defined in the 1940 Act), receives or is entitled to receive any compensation, directly or indirectly, from the investment company or its security holders (other than fees for bona fide investment advisory or other services), or from any person in connection with the purchase or sale of securities or other property to, from or on behalf of the investment company (other than ordinary fees for bona fide principal underwriting services). The Adviser has confirmed for the Board that the Transaction will not impose an unfair burden on the Fund within the meaning of Section 15(f) of the 1940 Act.

Second, during the three-year period following the Transaction, at least 75% of the members of the investment company’s board of trustees cannot be “interested persons” (as defined in the 1940 Act) of the sub-adviser (or predecessor sub-adviser). At the present time, 75% of the Trustees are classified as Independent Trustees; i.e., not interested persons of the Trust. The Board has committed to ensuring that at least 75% of the Trustees will not be “interested persons” of the Sub-Adviser for a period of three years after the Transaction.

Record Date Date/Shareholders Entitled to Vote. Each Fund is a separate series, or portfolio, of the Trust, a Delaware statutory trust and registered investment company under the 1940 Act. The record holders of outstanding shares of each Fund are entitled to vote one vote per share (and a fractional vote per fractional share) on all matters presented at the Special Meeting with respect to each Fund, including the Proposal.

Shareholders of each Fund at the close of business on [MayMay 9, 2023],2023, the Record Date, May 9, 2023, will be entitled to be present and vote at the Special Meeting. As of the close of business on the Record Date, May 9, 2023, the following shares of each Fund were issued and outstanding:

| Vident U.S. Bond Strategy ETF™ | []8,800,000 |

| Vident U.S. Equity Strategy ETF™ | []11,300,000 |

| Vident International Equity Strategy ETF™ | []15,700,000 |

| U.S. Diversified Real Estate ETF | []4,200,000 |

Voting Proxies. You should read the entire Proxy Statement before voting. If you have any questions regarding the Proxy Statement, please call toll-free 866-839-1852. If you sign and return the accompanying proxy card, you may revoke it by giving written notice of such revocation to the Secretary of the Trust prior to the Special Meeting or by delivering a subsequently dated proxy card or by attending and voting at the Special Meeting in person. Proxies voted by telephone or internet may be revoked at any time before they are voted by proxy voting again through the website or toll-free number listed in the enclosed proxy card. Properly executed proxies will be voted, as you instruct, by the persons named in the accompanying proxy card. In the absence of such direction, however, the persons named in the accompanying proxy card intend to vote “FOR” the Proposal and may vote at their discretion with respect to other matters not now known to the Board that may be presented at the Special Meeting. Attendance by a shareholder at the Special Meeting does not, in itself, revoke a proxy.

If sufficient votes are not received for the Proposal by the date of the Special Meeting, the Special Meeting may be adjourned with respect to such Proposal, once or more, by motion of the chair of the Special Meeting or by the vote of the holders of a majority of a Fund’s shares present at the Special Meeting in person or by proxy to permit further solicitation of proxies. If there is a vote to adjourn, persons named as proxies will vote all proxies in favor of adjournment that voted in favor of the Proposal and vote against adjournment all proxies that voted against the Proposal.

Quorum Required. Each Fund must have a quorum of shares represented at the Special Meeting, in person or by proxy, to take action on any matter relating to such Fund. Under the Trust’s Agreement and Declaration of Trust, as amended, a quorum is constituted by the presence in person or by proxy of at least one-third of the outstanding shares of a Fund entitled to vote at the Special Meeting.

Abstentions and broker non-votes (i.e., proxies from brokers or nominees indicating that they have not received instructions from the beneficial owners on an item for which the brokers or nominees do not have discretionary power to vote) will be treated as present for determining whether a quorum is present with respect to a particular matter. However, abstentions and broker non-votes will have the effect of a vote AGAINST the Proposal and any other matter that requires the affirmative vote of a Fund’s outstanding shares for approval. Abstentions and broker non-votes will not be counted as voting on any other matter at the Special Meeting when the voting requirement is based on achieving a plurality or percentage of the “voting securities present.”

If a quorum is not present at the Special Meeting, or a quorum is present at the Special Meeting but sufficient votes to approve a Proposal is not received, the chair of the Special Meeting or the holders of a majority of a Fund’s shares present at the Special Meeting, in person or by proxy, may adjourn the Special Meeting with respect to such Proposal to permit further solicitation of proxies.

Method and Cost of Proxy Solicitation. Proxies will be solicited by the Trust, the Adviser, and/or Morrow Sodali Fund Solutions, LLC, a professional proxy solicitor (the “Proxy Solicitor”), primarily by mail. The solicitation may also include telephone, facsimile, electronic or oral communications by certain officers or employees of the Trust or the Adviser, none of whom will be paid for these services, or by the Proxy Solicitor. The Adviser will pay the costs of the Special Meeting and the expenses incurred in connection with the solicitation of proxies, including any expenses associated with the services of the Proxy Solicitor. The Trust may also request broker-dealer firms, custodians, nominees and fiduciaries to forward proxy materials to the beneficial owners of the shares of the Funds held of record by such persons. The estimated cost of the Proxy Solicitor for their services soliciting proxies from brokers, banks and other nominee holders is approximately $5,000 per Fund. The Adviser may reimburse such broker-dealer firms, custodians, nominees, and fiduciaries for their reasonable expenses incurred in connection with such proxy solicitation, including reasonable expenses in communicating with persons for whom they hold shares of a Fund.

Meeting Venue. We intend to hold the Special Meeting in person at the offices of U.S. Bank Global Fund Services, 615 East Michigan Street, Milwaukee, Wisconsin 53202. However, we are sensitive to the public health and travel concerns our shareholders may have and recommendations that public health officials may issue in light of the evolving COVID-19 pandemic. As a result, we may impose additional procedures or limitations on Special Meeting attendees or may decide to hold the Special Meeting in a different location or solely by means of remote communication. We plan to announce any such updates on our proxy website www.proxyvote.com,www.videntam.com, and we encourage you to check this website prior to the Special Meeting if you plan to attend. We also encourage you to consider your options to vote by internet, telephone, or mail, as discussed in the enclosed proxy card, in advance of the Special Meeting in the event that, as of [JUNE 9],June 9, 2023, in-person attendance at the Special Meeting is either prohibited under a federal, state, or local order or contrary to the advice of public health care officials.

Distributor, Administrator and Transfer Agent. The Funds’ distributor and principal underwriter is ALPS Distributors, Inc., located at 1290 Broadway, Suite 1000, Denver, Colorado 80203. U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services, located at 615 East Michigan Street, Milwaukee, Wisconsin 53202, serves as the Funds’ transfer agent and administrator.

Share Ownership. To the knowledge of the Trust’s management, as of the close of business on [MAYMay 9, 2023],2023, the officers and Trustees of the Trust, as a group, beneficially owned less than one percent of each Fund’s outstanding shares and less than one percent of the Trust’s outstanding shares. To the knowledge of the Trust’s management, as of the close of business on [MAYMay 9, 2023],2023, persons owning of record more than 5% of the outstanding shares of a Fund are as listed in the table below. The Trust believes that most of the shares referred to below were held by the persons indicated in accounts for their fiduciary, agency or custodial customers. Any shareholder listed below as owning 25% or more of the outstanding shares of a Fund may be presumed to “control” (as that term is defined in the 1940 Act) the applicable Fund. Shareholders controlling a Fund could have the ability to vote a majority of the shares of the applicable Fund on any matter requiring the approval of that Fund’s shareholders.

Vident U.S. Bond Strategy ETF™

Name and Address | % Ownership | Type of Ownership |

National Financial Services, LLC 200 Liberty Street New York, NY 10281 | 97.83% | Record |

Ronald Blue Trust 1000 Health Park Drive, Suite 180 Brentwood, TN 37027 | 92.90%* | Beneficial |

*This figure is based on information reported on Form 13F as of March 31, 2023, the Trust believes Ronald Blue Trust owns a majority of the Fund’s shares as of Record Date.

Vident U.S. Equity Strategy ETF™

Name and Address | % Ownership | Type of Ownership |

National Financial Services, LLC 200 Liberty Street New York, NY 10281 | 96.86% | Record |

Ronald Blue Trust 1000 Health Park Drive, Suite 180 Brentwood, TN 37027 | 89.94%* | |

| | |

| | |

| | |

| | |

| | Beneficial |

*This figure is based on information reported on Form 13F as of March 31, 2023, the Trust believes Ronald Blue Trust owns a majority of the Fund’s shares as of Record Date.

Vident U.S.International Equity Strategy ETF™

| | |

Name and Address | % Ownership | Type of Ownership |

National Financial Services, LLC 200 Liberty Street New York, NY 10281 | 94.30% | Record |

Ronald Blue Trust 1000 Health Park Drive, Suite 180 Brentwood, TN 37027 | 91.65%* | |

| | |

| | |

| | |

| | |

| | |

| | Beneficial |

*This figure is based on information reported on Form 13F as of March 31, 2023, the Trust believes Ronald Blue Trust owns a majority of the Fund’s shares as of Record Date.

Vident International Equity Strategy ETF™U.S. Diversified Real Estate ETF

| | |

Name and Address | % Ownership | Type of Ownership |

National Financial Services, LLC 200 Liberty Street New York, NY 10281 | 85.01% | |

| | |

| | |

| | |

| | |

| | |

| | |

U.S. Diversified Real Estate ETF

| | Record |

Name and AddressRonald Blue Trust

1000 Health Park Drive, Suite 180 Brentwood, TN 37027 | % Ownership

73.59%* | Type of Ownership

Beneficial |

Charles Schwab & Co., Inc. 211 Main Street San Francisco, CA 94105 | 6.62% | |

| | |

| | |

| | |

| | |

| | |

| | |

| | Record |

*This figure is based on information reported on Form 13F as of March 31, 2023, the Trust believes Ronald Blue Trust owns a majority of the each Fund’s shares as of Record Date.

Reports to Shareholders. Copies of the Funds’ most recent annual and semi-annual reports may be requested without charge by writing to the Funds, c/o U.S. Bank Global Fund Services, 615 East Michigan Street, Milwaukee, Wisconsin 53202 or by calling toll-free 1-800-617-0004.

Other Matters to Come Before the Special Meeting. The Trust’s management does not know of any matters to be presented at the Special Meeting other than the Proposal described above. If other business should properly come before the Special Meeting, the proxy holders will vote thereon in accordance with their best judgment.

Shareholder Proposal. The Agreement and Declaration of Trust, as amended, and the Amended and Restated By-laws of the Trust do not provide for annual meetings of shareholders, and the Trust does not currently intend to hold such meetings in the future. Shareholder proposal for inclusion in a proxy statement for any subsequent meeting of the Trust’s shareholders must be received by the Trust a reasonable period of time prior to any such meeting.

Householding. If possible, depending on shareholder registration and address information, and unless you have otherwise opted out, only one copy of this Proxy Statement will be sent to shareholders at the same address. However, each shareholder will receive separate proxy cards. If you would like to receive a separate copy of the Proxy Statement, please call 866-839-1852. If you currently receive multiple copies of Proxy Statements or shareholder reports and would like to request to receive a single copy of documents in the future, please call 1-800-617-0004 or write to the Funds, c/o U.S. Bank Global Fund Services at 615 East Michigan Street, Milwaukee, Wisconsin 53202.

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting.

This Proxy Statement is available on the internet at [www.proxyvote.com].https://proxyvotinginfo.com/p/videntetfs2023. Use the control number on your proxy card to vote by internet or by telephone. You may request a copy by mail (Vident Funds, c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, WI 53201-0701) or by telephone at 866-839-1852. You may also call for information on how to obtain directions to be able to attend the Special Meeting and vote in person.

EXHIBIT A

ETF SERIES SOLUTIONS